Some exciting data we have from the 2017 USDA National Hop Report.

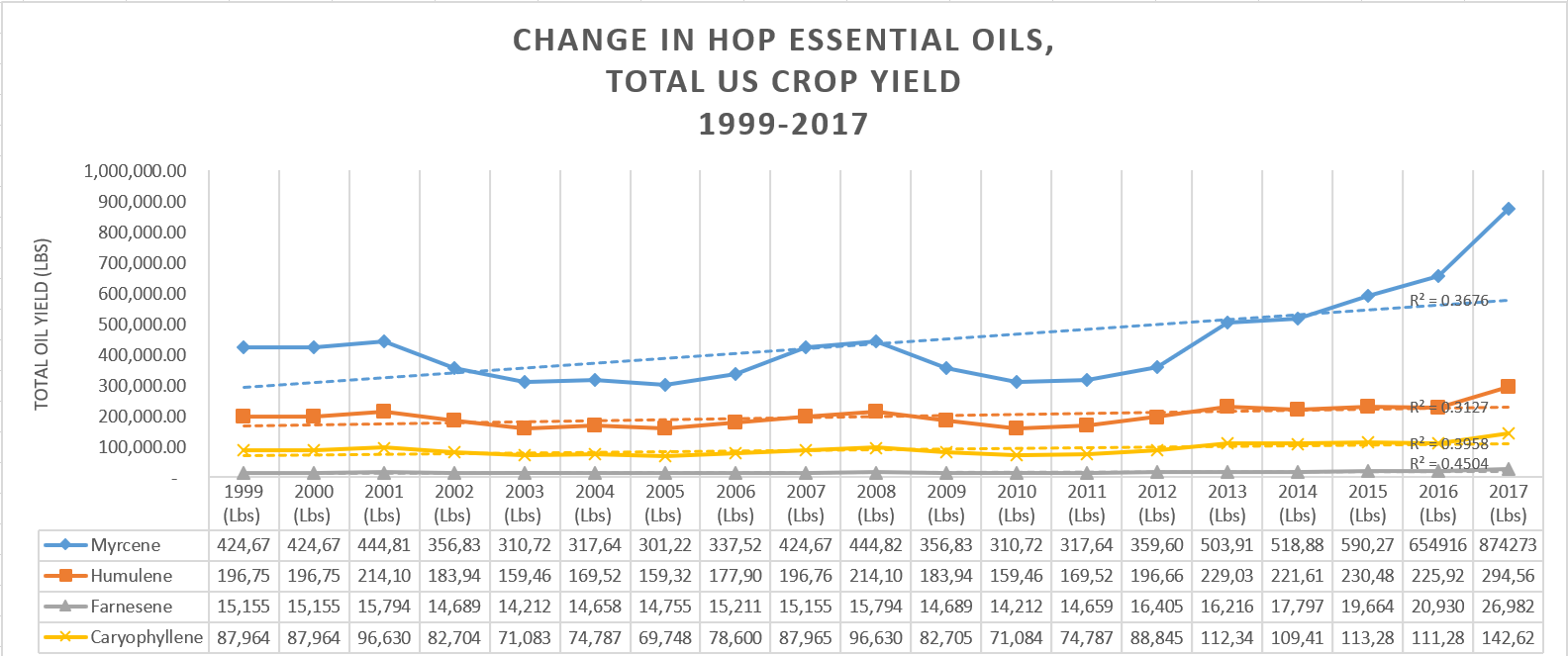

Using the same model we constructed from the 2015 data, we were able to see not just a continuing trend myrcene-forward hops, we are also seeing specific declines of older hops. In the coming posts, we will focus on why this is likely happening.

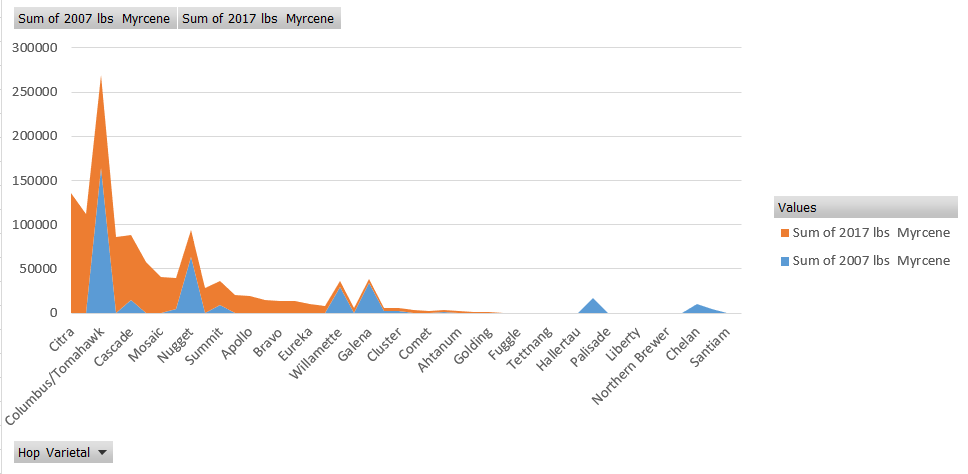

Why are we seeing this takeoff of myrcene? Simple–it’s a common major essential oil (terpene) in most of the citrus-forward hops.

When we compare harvest of myrcene as an essential oil (terpene) in the past ten years, we can see in an area chart that the popularity of the oil is evident in its sheer volume of harvests. In fact, most of these newer hops (such as Citra) didn’t even exist in 2007, and as a result, we see a tremendous swing towards this flavor compound.

Indeed, we are seeing a terrific increase in hop harvests given the recent popularity of IPAs–but reading between the lines, we see that specific characteristics of these hops are the driving factor in consumers deciding their preferred flavor compounds.